When we think of HNIs and corporate investors we tend to believe that they make up their wealth only through the equity related instruments, but do you know that debt mutual funds are their most favorite and they often term them as best mutual funds to invest?

The proof is in the pudding of making great tax-free returns from the debt fund investments. Note that we are not talking about ELSS or tax saver funds but debt funds which are used as a tax saving options here, if you know the trick you can very well earn up to 2% additional tax benefit on your returns. If you want to know why debt funds are called best mutual funds…. read the complete article.

Types of Debt Funds

As per SEBI’s guidelines, every mutual fund should display the minimum period for which the investor should stay invested into that fund we call that maturity period. This is one of the main parameters to identify some of best mutual funds across various maturity periods. Overall, we can segregate the debt funds into 2 types:

- Short term debt funds

- Long term debt funds

A) Short term debt funds

These are the debt funds whose maturity period ranges from 1 day (overnight funds) to 18 months. These are the best mutual funds for the people who don’t want to stay invested for long.

Types of Short term debt funds

1. Overnight funds: The fund manager selects the debt bonds in such a way that the mutual fund is expected to mature in 1 day only. But the return would be somewhat low but is better than a savings bank or FD interest rate.

2. Liquid funds: The bonds that the fund manager invests in should not have a maturity period or tenure for more than 90 days as per SEBI’s guidelines. This is a popular choice for the scenario involving the return for investment in short time. Although previously there was no Exit load for liquid funds, now an exit load will be levied on the investor if he/ she wishes to withdraw the money within 1 week of investing into the fund.

3. Ultra-short duration Funds: The respective mutual fund should have the maturity period between 3 months to 6 months and the return rate will change respectively favoring the higher tenure on an average.

4. Low duration Funds: The fund manager would invest in bonds or papers that promise to return the money in 6 months to 1 year. So, if the investor has the investment horizon up to 1 year, they can wish to invest in this category of the MF for a better return on their investment.

5. Money Market Funds: Fund manager would invest in cash and cash equivalent instruments that would mature in about 1 year. It’s considered a high liquid mutual funds.

6. Short duration funds: The fund manager would pick and invest in the debt instruments that would mature anywhere from 1 Year to 3 Years of time. So, if an investor who has the investment horizon of at least 1 year can invest in such mutual funds.

B) Long term debt funds

When we speak about long terms funds, we are generally talking about the debt funds which have the maturity period greater than 18 months. Typically, over 2 years. These are best mutual funds for people who want to stay in for the long haul and make best returns from their investment through mutual funds.

Types of Long term debt funds

1. Medium duration fund: Funds manager would invest in bonds that promises the maturity period to be between 3 to 4 yrs.

2. Medium to long duration funds: The duration of the mutual fund is from 4 yrs to 7 yrs.

3. Long duration funds: The fund manager always has to maintain the MF maturity time above 7 years compulsorily as per SEBI’s guidelines.

4. Dynamic bond funds: Every other debt fund has a compulsion to fulfil the minimum time duration for the mutual fund. The advantage of the dynamic bonds is that it doesn’t have any particular time duration that requires the fund to be held on to a particular period of time. It’s purely fund manager’s call to whether increase or decrease the fund duration of that particular Dynamic bond mutual fund to make sure it’s one of the best mutual funds for investors.

5. GILT Funds: The fund manager must invest at least 80% of the fund’s AUM (Asset under management) into Government securities only. Moreover, the MF tenure should not be less than 10 yrs.

6. Banking & PSU fund: Fund manager should invest at least 80% of the AUM into Banks or PSUs or Public financial bonds.

7. Floating Interest fund: Fund manager should invest at least 65% of the AUM into the bonds with floating (changing) interest rates.

8. Corporate bond funds: Fund manager should invest at least 80% of the AUM into highest rated corporate bonds i.e., funds with AAA or equivalent rating.

9. Credit Risk funds: Fund manager should invest at least 65% of AUM into below highest rated funds i.e., funds with AA- or below ratings.

Identifying best mutual funds to invest

Now that we know the types of debt mutual funds and their respective maturity period, let’s understand how to choose best mutual funds which can multiply our wealth.

Try to select a mutual fund with the tenure that matches your investment time horizon.

If you plan to stay invested in a debt fund for a period of 1 Yr, then try to pick a mutual fund that has time duration of 1 Yr or more but not for some fund whose tenure is less than 1 year. This should be followed to avoid unnecessary fluctuations to your investment and getting deviated from your goal. Always choose to invest in the best mutual funds which are inline with your risk appetite and investment time horizon.

How RBI and the interest rate hikes affect mutual fund’s returns?

We might have come across about the news that RBI increasing and decreasing the interest rates of lending and borrowing. Have you ever wondered what that actually is and why do we really need to care about it?

In our hunt to find some of the best mutual funds, we need to first understand the relation between the RBI’s interest rate and the bond prices. So, whenever RBI reduces interest rates, the bond prices would creep up and increase and when the interest rates are hiked, the bond prices would fall subsequently.

To understand how it works, imagine a corporation that had floated bonds with a return of 10% and then RBI would reduce the interest rate by 1% which means when that company reissues the bonds it would be promising a return on 9%, now in open market people would prefer buying the bonds with 10% over the current 9% one which would trigger a price increase and vice-versa when RBI increases the interest rates which reduces the bond price based on demand and supply.

Investment strategy for higher returns with best mutual funds

Let us now understand an important concept using which HNIs earn a lot of their wealth from and save a ton of taxes. To know how, we need to understand yield till maturity (YTM) and Modified Duration (MD) of a debt mutual fund. These are 2 important parameters in deciding if a mutual fund can be considered in the list of best mutual funds for you.

YTM: This is an average return percentage promised of that bond, a mutual fund would invest in. As we already know that mutual fund would invests in various bonds with different return percentages.

Modified Duration (MD): This is an average tenure/ time duration that the bonds would mature of a mutual fund as, single mutual fund will invest in various bonds with different return tenures.

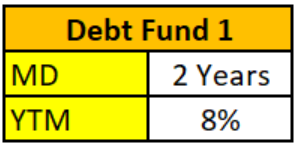

Assume 2 funds with different MD and YTM as below

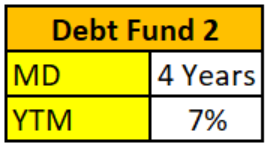

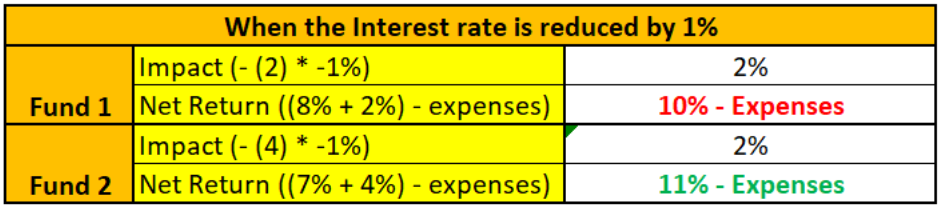

Based on interest rate change, the average return percentage would change and the total calculation is as below.

Impact = (-) (MD * changed Interest rate)

Net return = (YTM + Impact) – Expenses

here expenses are the charges incurred by MFs levied on investors.

Based on above formula, if there is going to be an increase in interest rate, the returns would be high in mutual funds with less MD and high YTM and vice versa when the interest rates are slashed.

So, HNIs would leverage this and hedge their investments from time to time to get higher rate of return compared to a regular debt mutual fund justifying the argument that debt funds are the best mutual funds over regular funds.

Tax benefit investing in debt funds

The main thing that makes debt mutual funds as best mutual funds to invest is indexation, using which HNIs save a huge amount of money through tax saving. Because of indexation, an investor in debt mutual fund can save up to 2% of total earnings combining which means the debt mutual funds are one of the best rewarding options for an instrument with a less rate of return compared to equity.

Bottom line

The variety that debt mutual fund provides when it comes to the maturity time and the return ratio are the key advantages that makes it the all-weather investment option i.e., best mutual funds to invest. The tax benefit of indexation acts as an icing on the cake making it a compulsory addition to the portfolio.

Nevertheless, one must not invest in any fund and must only pick the right fund as per their time horizon and risk appetite. Remember one thing, your list of best mutual funds might not match with other’s list pf best mutual funds as risk appetite and investment horizon varies from person to person.

Happy Investing!!!

Top site ,.. amazaing post ! Just keep the work on !

A few things i have generally told folks is that while searching for a good internet electronics retail store, there are a few variables that you have to remember to consider. First and foremost, you should really make sure to discover a reputable and reliable store that has received great evaluations and classification from other shoppers and industry advisors. This will ensure you are getting along with a well-known store providing you with good services and support to its patrons. Thank you for sharing your notions on this web site.

I not to mention my guys came looking through the nice items from your website while then I had a terrible feeling I never thanked you for those tips. My guys were definitely so happy to study them and already have without a doubt been having fun with these things. Thank you for actually being well helpful and then for picking certain very good subject areas millions of individuals are really eager to know about. Our sincere regret for not expressing appreciation to you sooner.

Itís hard to come by knowledgeable people about this subject, but you sound like you know what youíre talking about! Thanks

Very interesting subject, thanks for putting up.

It?¦s actually a great and useful piece of info. I am satisfied that you shared this helpful information with us. Please keep us informed like this. Thank you for sharing.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

Your article helped me a lot, is there any more related content? Thanks!